The Federal Reserve is raising interest rates, and that's led some to worry that mortgage rates will spike and put an end to the housing boom in the United States.

Not so fast, according to the head of a big homebuilder.

Stuart Miller, executive chairman of Miami-based builder Lennar, said Tuesday that "concerns about rising interest rates and construction costs have been offset by low unemployment and increasing wages."

Miller made those remarks in Lennar's earnings release Tuesday morning. The company reported revenue and profits that topped Wall Street's forecasts.

Shares of Lennar (LEN) surged more than 7% on the news. Rival builders Pulte (PHM), DR Horton (DHI), Toll Brothers (TOL) and KB Home (KBH) all rose too.

Lennar's results are an encouraging sign for the group, which has been hit hard this year on fears that higher interest rates will start to take a bite out of demand for new homes.

Builder stocks have been hit hard this year, with many of them -- including Lennar -- falling more than 20% in 2018.

But Lennar's results and other recent data may be assuaging fears that the bottom is going to fall out of the housing market.

The federal government said Monday that new home sales in May were better than expected, citing particular strength in the southern part of the US.

That should be good news for the broader economy.

Lewis Alexander, chief US economist at Nomura, said in a report Tuesday that he was raising his GDP estimate for the second quarter, citing the stronger home sales figures and expectations of higher broker commissions.

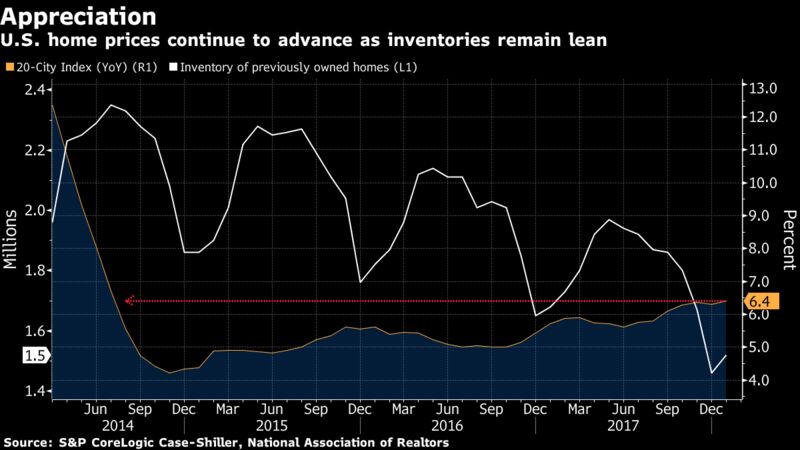

And according to the closely watched S&P Case-Shiller index that was released Tuesday morning, home prices continued to rise across the country -- with 17 of the 20 cities tracked in the index registering increases.

"Given the combination of strong demand and lean inventories, especially for existing homes, we expect home prices to continue appreciating at a modest pace for the remainder of the year," said Barclays economist Pooja Sriram in a report Tuesday.

As long as the housing market remains stable, that should give consumers more confidence. To that end, the government reported strong retail sales figures for May earlier this month.

And it was led by healthy gains at home-improvement stores like Home Depot (HD) and Lowe's(LOW). These chains tend to do well when people are looking to sell their home.

source: http://money.cnn.com/2018/06/26/investing/lennar-housing-market-home-building/index.html

for more real estate information and training, visit our website at http://rdtrainingsystems.com.